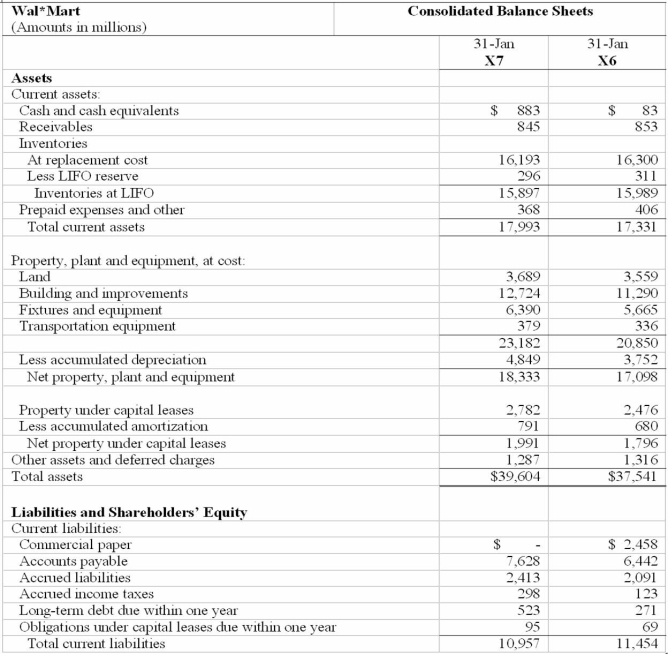

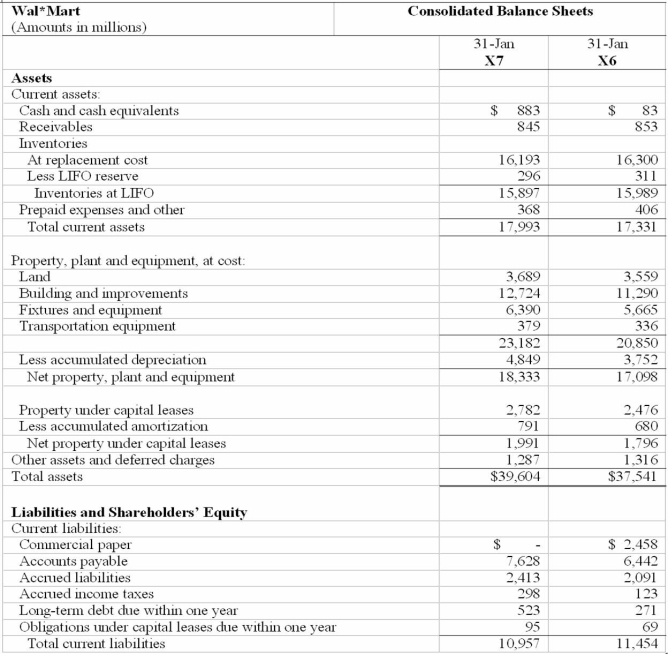

Long-term debt Long-term obligations under capital leases Deferred income taxes and other Minority interest Shareholders’ equity:Preferred stock ($ 10 par value, 100 shares authorized, none issued)Common stock ($ .10 par value, 5,500 shares authorized, 2,285 and2,293 issued and outstanding in X6 and X 7, respectively)Capital in excess of par valueRetained earningsForeign currency translation adjustment Total shareholders’ equityTotal liabilities and shareholders’ equity7,7092,3074631,02522854716,768(400)17,143$39,6048,5082,09240033122954514,394(412)14,756$37,541

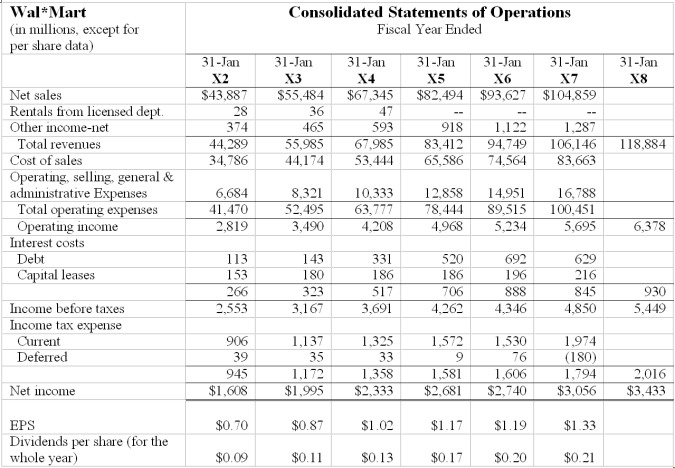

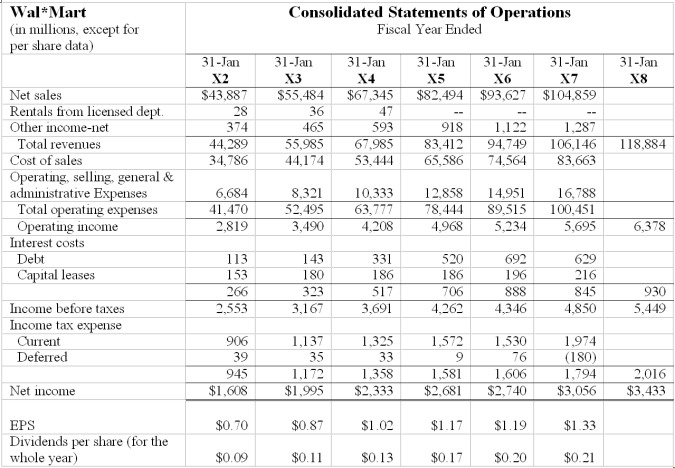

a. Calculate return on common equity (ROCE) for fiscal X4 and X7. Identify, as far as allowed by the data, components driving any changes in ROCE from X4 to X7. (If you want to give students more guidance then ask to disaggregate ROCE into net operating profit margin, net operating asset turnover and leverage.)

b. Compare and contrast the change in earnings per share to ROCE over this time period.

Definitions:

Mixed Numeral

A number made up of a whole number and a fraction, such as 3 1/2.

Well-Defined

Clearly specified or explained, leaving no ambiguity.

Initial State

The condition or position of a system, process, or situation at its start before any changes have occurred.

Improving Marriage

Efforts or actions aimed at enhancing the quality and satisfaction of a marital relationship.