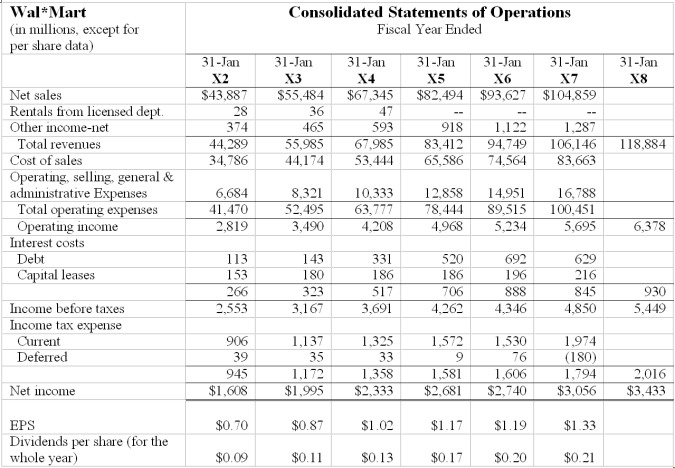

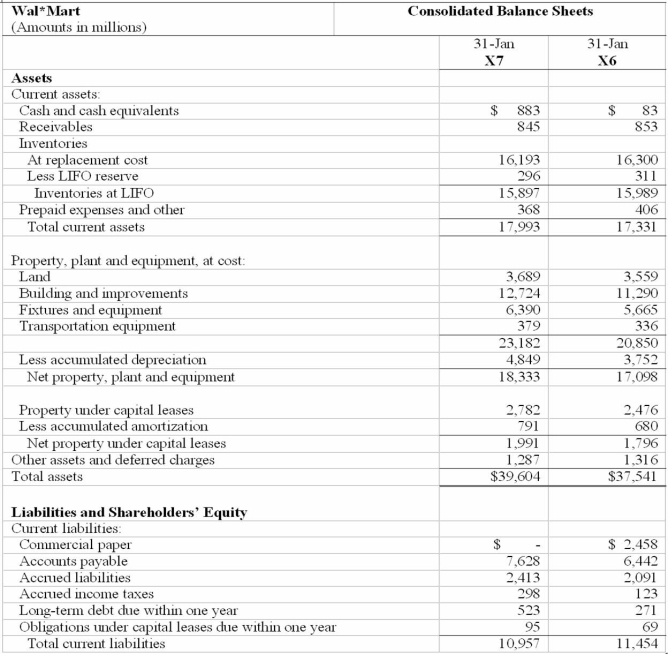

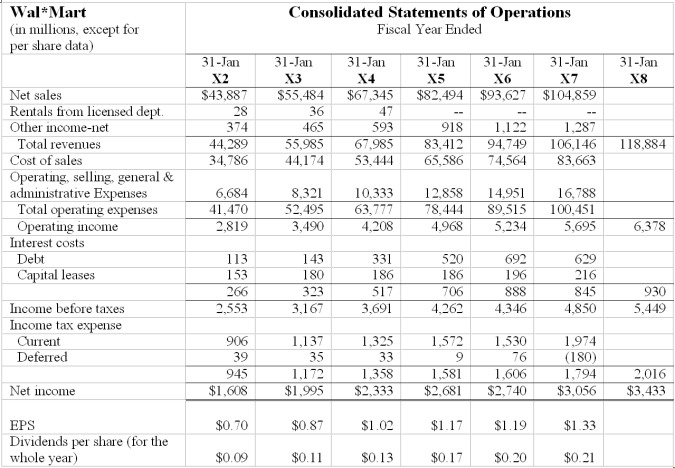

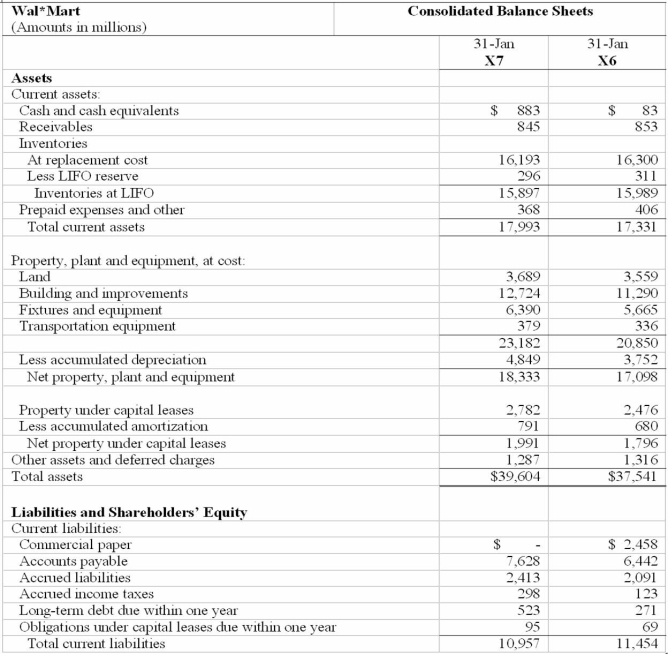

Long-term debt Long-term obligations under capital leases Deferred income taxes and other Minority interest Shareholders’ equity:Preferred stock ($ 10 par value, 100 shares authorized, none issued)Common stock ($ .10 par value, 5,500 shares authorized, 2,285 and2,293 issued and outstanding in X6 and X 7, respectively)Capital in excess of par valueRetained earningsForeign currency translation adjustment Total shareholders’ equityTotal liabilities and shareholders’ equity7,7092,3074631,02522854716,768(400)17,143$39,6048,5082,09240033122954514,394(412)14,756$37,541

a. Calculate return on common equity (ROCE) for fiscal X4 and X7. Identify, as far as allowed by the data, components driving any changes in ROCE from X4 to X7. (If you want to give students more guidance then ask to disaggregate ROCE into net operating profit margin, net operating asset turnover and leverage.)

b. Compare and contrast the change in earnings per share to ROCE over this time period.

Definitions:

Hydras

Freshwater organisms belonging to the phylum Cnidaria, known for their simple tubular body and radial symmetry.

Complete Digestive System

A digestive system that has two separate openings for ingestion and egestion, allowing for a one-way flow of food and efficient digestion.

Flatworms

A group of invertebrates belonging to the phylum Platyhelminthes, characterized by their flattened bodies, bilateral symmetry, and lack of body cavity.

Anus

The opening at the end of the digestive tract through which feces exit the body.