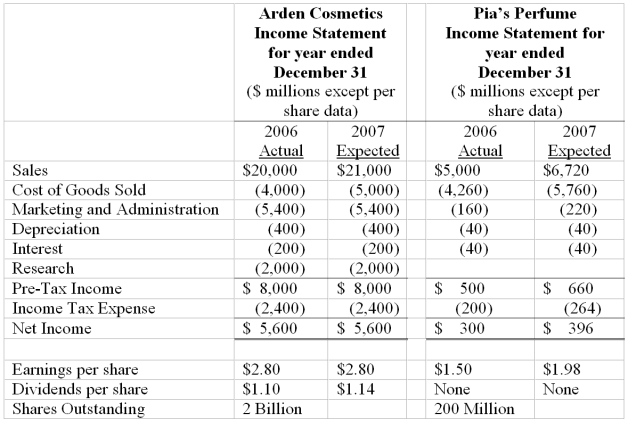

Below are the financial statements for Arden Cosmetics and Pia's Perfume.

Arden is considering two alternative approaches to making the acquisition of Pia: share-for-share exchange or cash purchase. Assume the following: - The billion dollar cost of purchasing Pia at per share would be financed by debt with a 10 percent interest rate.

- All assets and liabilities of Pia have fair market values equal to their balance sheet values except property, plant and equipment, which have a fair market value of billion. Pia depreciates its property, plant, and equipment over 10 years using the straight-line method.

- The marginal tax rate is 40 percent.

Part a.

Assume Arden uses a share-for-share exchange to acquire Pia and accounts for the transaction as a pooling-of-interests:

i. Prepare a pro forma December 31, 2006 balance sheet for Arden reflecting the acquisition and calculate the resulting book value per share.

ii. Prepare a pro forma estimated 2007 income statement for Arden reflecting the acquisition, and calculate the resulting earnings per share.

Part b.

Assume Arden pays $30 cash per share to acquire 100 percent of the common stock of Pia and accounts for the transaction as a purchase.

i. Prepare a pro forma December 31, 2006 balance sheet for Arden reflecting the acquisition and calculate the resulting book value per share.

ii. Prepare a pro forma estimated 2007 income statement for Arden reflecting the acquisition, and calculate the resulting earnings per share.

Definitions:

Person Analysis

The process of assessing an individual's capabilities, skills, and developmental needs to optimize job performance.

Interpersonal Communication Skills

The abilities used to effectively exchange information, ideas, and feelings with others through verbal, non-verbal, written, and digital channels.

Conflicts

Disagreements or disputes arising from differences in attitudes, beliefs, values, or needs among individuals or groups.

Instructional Design Process

A systematic approach to creating educational and training programs in a consistent and reliable fashion to improve learning and efficiency.

Q20: Renzulli suggests that identification of students who

Q23: The goal of reframing is to celebrate

Q26: Analysis of profitability of a company is

Q34: Treasury stock is:<br>A) investments in government securities.<br>B)

Q37: Economic income measures change in:<br>A) asset value.<br>B)

Q48: Extraordinary items are defined as those that

Q62: Return on Common Equity for 2006 is:<br>A)

Q65: When examining the current ratio and trends

Q65: Which of the following statements could explain

Q80: One of the problems with pooling-of-interests accounting