Use the following to answer questions

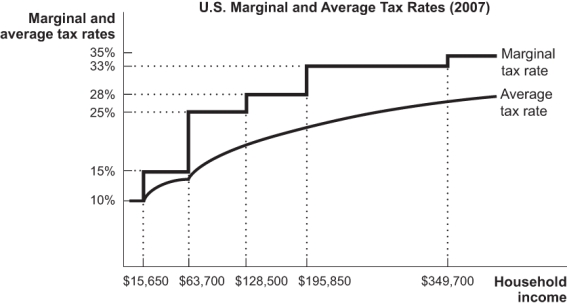

Figure: U.S.Marginal and Average Tax Rates

-(Figure: U.S.Marginal and Average Tax Rates) According to the tax rates shown in the figure,an individual who earns $150,000 a year has an approximate average tax rate of:

Definitions:

Productivity Gains

Increases in the amount of output produced per unit of input, reflecting improvements in efficiency, technology, or processes.

Transferability

The ability of an asset to be transferred or converted easily from one individual to another without affecting its value.

Human Capital

A collection of proficiencies, knowledge, or invisible assets owned by individuals that can be leveraged to bring about economic prosperity for themselves, their work environments, or their community.

Compensating Differential

A difference in wages that compensates workers for undesirable aspects of a job, such as hazardous working conditions or undesirable hours.

Q16: If country A exports $10 billion worth

Q29: Easy credit can start or intensify a

Q79: What are the two biggest sources of

Q83: In 2011,most of the 2009 federal stimulus

Q118: (Figure: Monetary Policy)Refer to the figure.Assume that

Q120: To reduce inflation in response to a

Q127: A negative shock to AD will cause

Q130: If the Federal Reserve responds to shocks

Q205: If the economy is hit by a

Q258: An asset that without loss of value