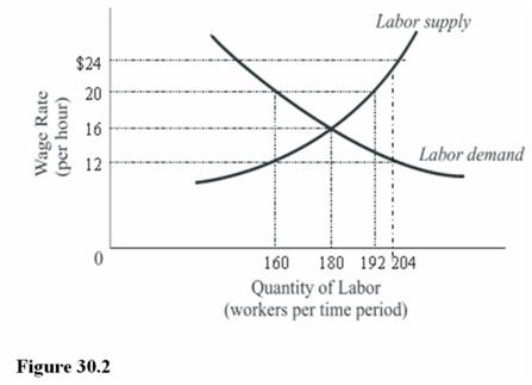

In Figure 30.2, a minimum wage of $20 will result in a

In Figure 30.2, a minimum wage of $20 will result in a

Definitions:

Marginal Tax Rate

The rate at which the last dollar of income is taxed, reflecting the percentage of additional income that is paid in taxes.

Average Tax Rate

The ratio of the total amount of taxes paid to the total income, showing the share of income that goes to taxes.

Income Tax System

The framework by which governments collect a percentage of income from individuals and businesses as tax, which varies according to earnings levels.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, representing the percentage of additional income that is paid in tax.

Q42: An advantage of set-aside programs over price

Q53: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5718/.jpg" alt=" In Figure 30.1,

Q64: If Janella increases her supply of labor

Q75: Public education is an in-kind benefit.

Q85: If a natural monopoly was forced to

Q89: Deregulation of the railroad industry led to<br>A)

Q102: <table > <tbody>

Q109: Suppose European incomes increase by 4 percent

Q138: The Kyoto Treaty of 1997 on global

Q138: A tax is progressive if it takes