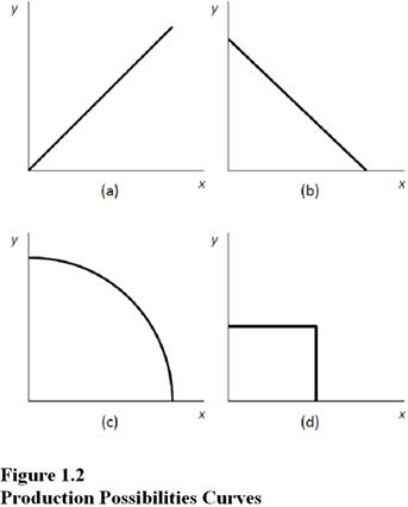

Choose the letter of the curve in Figure 1.2 that best represents a production possibilities curve for two goods for which there are constant opportunity costs:

Choose the letter of the curve in Figure 1.2 that best represents a production possibilities curve for two goods for which there are constant opportunity costs:

Definitions:

Regressive Tax Structure

A tax system where the rate decreases as the taxable amount increases, disproportionately affecting lower-income individuals.

Proportion

A part, share, or number considered in comparative relation to a whole.

Income

The money received by an individual or group for their labor, investments, or other revenue-generating activities.

Progressive Tax Structure

A tax system in which the tax rate increases as the taxable amount or income increases, imposing a higher percentage rate on higher income earners.

Q7: Over a given period of time, if

Q30: According to the World View chart in

Q37: Specialization in production and then trading with

Q52: The knowledge and skills possessed by the

Q63: Outsourcing is a source of increased U.S.output.

Q72: What is government failure, and how would

Q73: An inequality trap has a negative impact

Q107: Which of the following is not an

Q112: State income tax revenues are much less

Q144: In-kind transfers include the direct transfer of<br>A)Cash