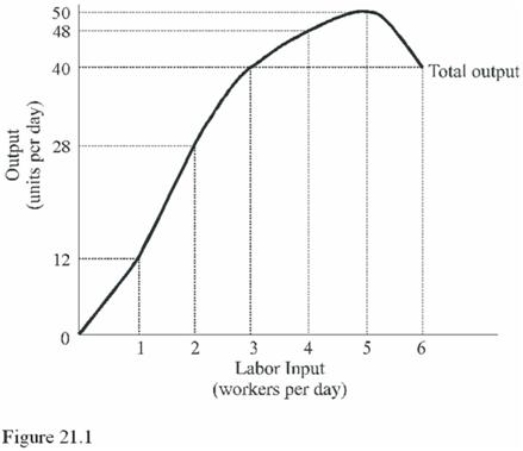

In Figure 21.1, diminishing marginal returns first occur with the

In Figure 21.1, diminishing marginal returns first occur with the

Definitions:

Capital Gains

The profit from the sale of assets such as stocks, bonds, or real estate, which exceeds the original purchase price.

Preferential Tax Treatment

Financial policies or regulations that reduce tax rates or alter tax policies in favor of certain businesses, industries, or transactions.

Capital Investments

Expenditures by a business to acquire or upgrade physical assets such as property, industrial buildings, or equipment.

Mortgage Exemption

A provision in tax law or regulation that allows certain mortgage payments, interest, or property taxes to be excluded from taxable income.

Q17: The World View "High Gold Price Swells

Q28: An attempt by one oligopolist to increase

Q33: The primary purpose of antitrust policy in

Q48: Short-run supply determinants include<br>A)Technology.<br>B)Number of buyers.<br>C)Income.<br>D)Consumer preferences.

Q77: Total utility is<br>A)The additional utility from consuming

Q105: In defining economic costs, economists emphasize<br>A)Explicit and

Q107: In making an investment decision, an entrepreneur<br>A)Treats

Q114: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5719/.jpg" alt=" Refer to Figure

Q114: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5719/.jpg" alt=" Refer to Figure

Q130: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5719/.jpg" alt=" Refer to the