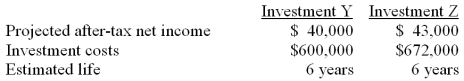

A company has a decision to make between two investment alternatives. The company requires a 10% return on investment. Predicted data is provided below:

The present value of an annuity for 6 years at 10% is 4.3553. This company uses straight-line depreciation.

Required:

(a) Calculate the net present value for each investment.

(b) Calculate the profitability index for each investment.

(c) Which investment should this company select? Explain.

Definitions:

Area

A quantity expressing the two-dimensional size or extent of a shape or surface, typically measured in square units.

Variance

A measure of dispersion in a set of data points, calculated by taking the average of the squared differences from the mean.

Standard Deviation

A statistic that quantifies the dispersion or variability of a dataset, measuring the average distance between each data point and the mean.

Z-score

A quantitative measure that demonstrates the correlation of a specific value to the mean of a dataset, identifying its separation from the mean by counting the standard deviations.

Q13: The responsibility for coordinating the preparation of

Q17: A golfer, centered in a b

Q41: One of the major benefits of formal

Q71: A company expects to produce and

Q78: What is the total labor efficiency variance?<br>A)

Q86: General Chemical produced 10,000 gallons of Greon

Q89: A budget is a formal statement of

Q106: Table 1.3 shows the hypothetical trade-off

Q129: An unfavorable variance is recorded with a

Q147: Standard costs are used to measure:<br>A) Price