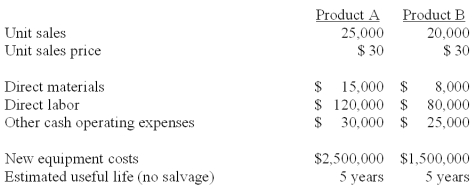

A company is trying to decide which of two new product lines to introduce in the coming year. The company requires a 12% return on investment. The predicted revenue and cost data for each product line follows:

The company has a 30% tax rate and it uses the straight-line depreciation method. The present value of an annuity of 1 for 5 years at 12% is 3.6048. Compute the net present value for each piece of equipment under each of the two product lines. Which, if either of these two investments is acceptable?

Definitions:

Series RC

A circuit configuration consisting of a resistor (R) and a capacitor (C) connected in a series arrangement.

Apparent Power

The total power in an AC circuit, equal to the product of the voltage and current, measured in volt-amperes (VA).

RC Circuit

An electrical circuit composed of resistors and capacitors used to filter or time delay signals.

Voltage Drop

The reduction in voltage as electric current flows through passive elements (like resistors) in a circuit.

Q2: Find (a) the dot product of

Q7: Use the formula <span class="ql-formula"

Q26: Use the following cost information to calculate

Q34: Based on predicted production of 25,000 units,

Q42: If the $450 cost of the 300

Q54: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5719/.jpg" alt=" At which point

Q114: Costs already incurred in manufacturing the units

Q115: The decision to accept additional business should

Q134: What is capital budgeting? Why are capital

Q158: Woods, Inc.'s budget included the following