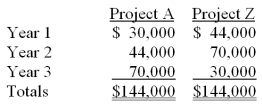

A company is considering two alternative investment opportunities, each of which requires an initial cash outlay of $110,000. The expected net cash flows from the two projects follow:

Required:

(1) Based on a comparison of their net present values, and assuming the same discount rate (greater than zero) is required for both projects, which project is the better investment? (Check one answer.)

________________ Project A

________________ Project Z

________________ The projects are equally desirable

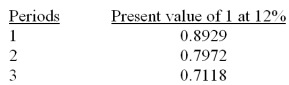

(2) Use the table values below to find the net present value of the cash flows associated with Project A, discounted at 12%:

Definitions:

Template DNA

The strand of DNA that serves as the guide for synthesizing a complementary strand during DNA replication or transcription.

Replication

The method whereby a double-helix DNA molecule replicates itself to create two duplicate DNA molecules.

DNA Polymerase

An enzyme that plays a critical role in DNA replication, facilitating the synthesis of a new strand of DNA by adding nucleotides matched to the template strand.

Adds Nucleotides

A process that involves the addition of nucleotide units to a nucleic acid molecule such as DNA or RNA.

Q1: Solve the equation: <span class="ql-formula"

Q31: Opportunity cost may be defined as the<br>A)Goods

Q34: A company is considering the purchase

Q43: Capital budgeting decisions usually involve analysis of:<br>A)

Q59: Capital budgeting decisions are generally based on:<br>A)

Q72: What is the balanced scorecard and how

Q82: What is a transfer price and what

Q104: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5719/.jpg" alt=" At which point

Q109: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB5719/.jpg" alt=" In Figure 1.6,

Q143: A cost variance is the difference between