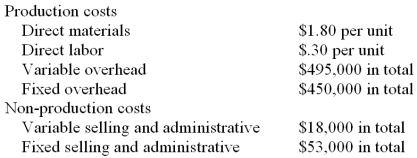

Stonehenge Inc., a manufacturer of landscaping blocks, began operations on April 1 of the current year. During this time, the company produced 750,000 units and sold 720,000 units at a sales price of $9 per unit. Cost information for this period is shown below.

(a.) Prepare Stonehenge's December 31st income statement for the current year under absorption costing.

(b.) Prepare Stonehenge's December 31st income statement for the current year under variable costing.

Definitions:

Q20: Which of the following is true when

Q50: The _ is the target of the

Q81: Static budget is another name for:<br>A) Standard

Q81: Product level costs do not vary with

Q98: Sindler Corporation sold 3,000 units of its

Q110: Absorption costing is useful because it reflects

Q132: A company identified the following partial

Q151: A company estimates that overhead costs for

Q153: Lemon Yellow Company produces children's clothing which

Q158: Woods, Inc.'s budget included the following