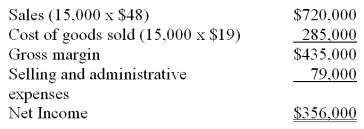

Anchovy, Inc., a producer of frozen pizzas, began operations this year. During this year, the company produced 16,000 cases of pizza and sold 15,000. At year-end, the company reported the following income statement using absorption costing.

Production costs per case total $19, which consists of $15.50 in variable production costs and $3.50 in fixed production costs (based on the 16,000 units produced). Eight percent of total selling and administrative expenses are variable. Compute net income under variable costing.

Definitions:

Perennial Crops

Plants that live for more than two years, providing agricultural output over multiple seasons without needing to be replanted annually.

Fossil Fuel

Natural fuels such as coal, oil, and natural gas, formed from the ancient remains of plants and animals and used for energy.

Soil Erosion

The removal of the top layer of soil at a faster rate than it is formed, due to natural processes like wind and water flow or human activities such as farming.

Soil Erosion

The displacement of the upper layer of soil, causing a loss of fertility and land degradation.

Q19: The high-low method can be used to

Q38: A Company is preparing a cash budget

Q54: A company manufactures and sells a product

Q68: In process costing there is never a

Q88: The difference between the total budgeted overhead

Q91: Wrap-It Company, a manufacturer of wrapping paper,

Q93: Dataport Company reports the following annual

Q134: A department had 65 units which were

Q137: When a process cost accounting system assigns

Q154: If the predetermined overhead allocation rate