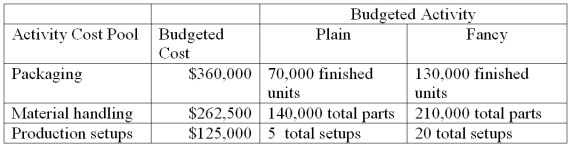

Sparks Company produces and distributes two types of garden sculptures, Plain and Fancy. Budgeted cost and activity for each of its three activity cost pools are shown below. The company plans to produce and sell 64,000 plain units and 49,150 fancy units.

(a.) Compute the approximate overhead cost per unit of Plain under activity-based costing.

(b.) Compute the approximate overhead cost per unit of Fancy under activity-based costing.

Definitions:

Plantwide Predetermined Rate

A single overhead absorption rate calculated for an entire manufacturing plant, used to allocate manufacturing overhead to individual products.

Machine-Hours

A measure of production time, indicated by the number of hours machines are operating in the manufacturing process.

Manufacturing Cost

The total cost incurred by a company to produce goods, including raw materials, labor, and overhead.

Calculated Selling Price

The calculated selling price is the price at which a product must be sold to cover its costs and achieve a desired profit margin.

Q27: Cost accounting systems accumulate costs and then

Q50: Lee Company manufactures and sells widgets for

Q75: A _ is a collection of costs

Q79: Look Up!, Inc. manufactures and distributes three

Q102: A major disadvantage of using a plantwide

Q109: The purchase of raw materials on account

Q141: Shore Company reports the following information

Q157: What is the reason for pooling costs?<br>A)

Q168: _ is the amount remaining from sales

Q172: _ is a costing method that includes