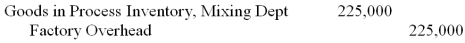

If the predetermined overhead allocation rate is 225% of direct labor cost, and the Mixing Department's direct labor cost for the reporting period is $10,000, the following entry would be made to record the allocation of overhead to the products processed in this department:

Definitions:

Income Statement

A financial statement that shows a company's revenue and expenses over a specific period, revealing net profit or loss.

Selling Expense

Costs incurred directly related to the sale of a product or service, including advertising, shipping, and sales staff salaries.

Delivery Expense

Costs incurred by a business for the transportation or delivery of goods to customers, often classified as an operating expense.

Periodic Inventory System

An inventory accounting system where updates to the inventory accounts occur at specific periods rather than continuously, often requiring a physical count.

Q21: A company's January 1 goods in process

Q39: The final step of activity-based costing assigns

Q43: Base Runner, Inc. manufactures baseball bats

Q51: Assume that the Hood River Juice Company

Q53: What is the high-low method? Briefly describe

Q59: A company uses activity-based costing to

Q67: On a typical cost-volume-profit graph, unit sales

Q88: The FIFO method of process costing computes

Q100: A system of accounting for manufacturing operations

Q165: A company identified the following partial