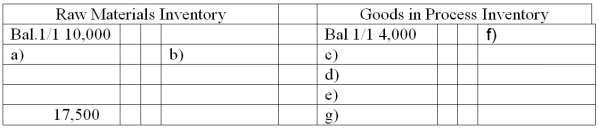

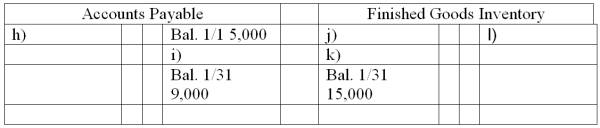

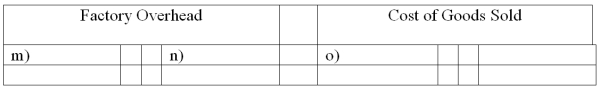

Medlar Corp. maintains a Web-based general ledger. Overhead is applied on the basis of direct labor costs. Its bookkeeper accidentally deleted most of the entries that had been recorded for January. A printout of the general ledger (in T-account form) showed the following:

A review of the prior year's financial statements, the current year's budget, and January's source documents produced the following information:

(1) Accounts Payable are used for raw material purchases only. January purchases were $49,000.

(2) Factory overhead costs for January were $17,000 none of which is indirect materials.

(3) The January 1 balance for finished goods inventory was $10,000.

(4) There was a single job in process at January 31 with a cost of $2,000 for direct materials and $1,500 for direct labor.

(5) Total cost of goods manufactured for January was $90,000.

(6) All direct laborers earn the same rate ($13/hour). During January, 2,500 direct labor hours were worked.

(7) The predetermined overhead allocation rate is based on direct labor costs. Budgeted (expected) overhead for the year is $195,000 and budgeted (expected) direct labor is $390,000.

Write in the missing amounts a through o above in the T-accounts above.

Definitions:

Psychological Health

An individual's overall state of mental, emotional, and psychological well-being.

Romantic Relationship

A type of interpersonal relationship that involves emotional and/or physical intimacy, typically characterized by love, commitment, and attraction.

Theory Construction

The process of systematically developing and organizing ideas to explain a phenomenon.

Sentimentality Analyzing

The process of examining emotions and feelings that evoke a tender or nostalgic sense, often to understand their impact on behavior and thought.

Q3: A manufacturing firm that produces a large

Q7: Equipment costing $100,000 with accumulated depreciation of

Q40: Time Bender Company makes watches and clocks.

Q66: The R&R Company's manufacturing costs for August

Q99: Hardy Co.'s cost of goods manufactured for

Q118: A company has an overhead application rate

Q131: The following information is available for the

Q152: Yellow Company uses a plantwide overhead rate

Q175: Fraud affects all business.

Q182: The comparison of a company's financial condition