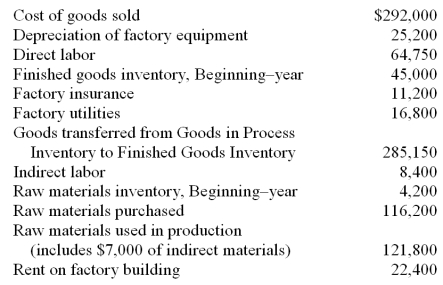

The following information is available for the Millennium Corporation for the current year:

Millennium Corporation uses a predetermined overhead rate of 150% of direct labor cost. Prepare journal entries for the following transactions/and events:

(a) Purchase of raw materials on account.

(b) Assignment of materials costs to Goods in Process Inventory and Factory Overhead

(c) Payment of Factory Payroll in cash

(d) Assignment of Factory Payroll to Goods in Process Inventory and Factory Overhead

(e) Recording of other factory overhead. Assume that all items other than depreciation are paid in cash.

(f) Assignment of Factory Overhead to Goods in Process Inventory

(g) Transfer of goods completed to Finished Goods Inventory

(h) Recording cost of goods sold

(i) Assignment of over- or underapplied overhead to Cost of Goods Sold

Definitions:

Percentage Increase

A mathematical calculation that determines the degree of growth of a figure or value in comparison to its original amount, expressed as a percentage.

Net Income

The total earnings of a company after all expenses and taxes have been deducted from total revenue, indicating the company's profit.

Year 1

A term typically used to refer to the first year of an activity, study, or business operation.

Liquidity Ratios

Financial metrics used to evaluate a company's ability to meet its short-term obligations, indicating its financial health.

Q9: Expenditures incurred in the process of converting

Q13: A department had 12,500 units which were

Q14: Four factors come together in the manufacturing

Q20: The gross margin ratio, return on total

Q31: Because departmental overhead costs are allocated based

Q82: Total manufacturing costs incurred during the year

Q115: The balanced scorecard aids in continuous improvement

Q118: A company has an overhead application rate

Q122: A company had total assets of $1,760,000,

Q175: When defining direct costs and indirect costs