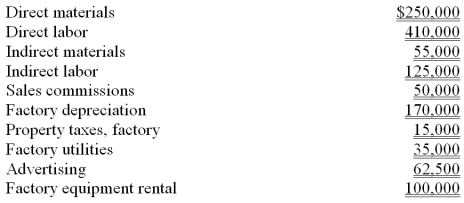

The predetermined overhead allocation rate for Forsythe, Inc. is based on estimated direct labor costs of $400,000 and estimated factory overhead of $500,000. Actual costs incurred were:

(a) Calculate the predetermined overhead rate and calculate the overhead applied during the year.

(b) Determine the amount of over- or underapplied overhead and prepare the journal entry to eliminate the over- or underapplied overhead assuming that it is not material in amount.

Definitions:

Q24: The manufacturing statement must be prepared monthly

Q41: Use the following information and the indirect

Q84: When factory payroll for indirect labor is

Q91: Bean Company uses a job order cost

Q93: Compute Aztec's departmental overhead rate for the

Q111: Job order costing is applicable to manufacturing

Q125: Raw materials that physically become part of

Q135: The following information is available for

Q135: Overapplied or underapplied overhead should be removed

Q152: Total quality management and just-in-time manufacturing are