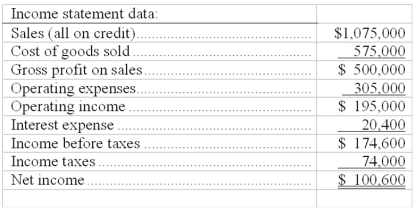

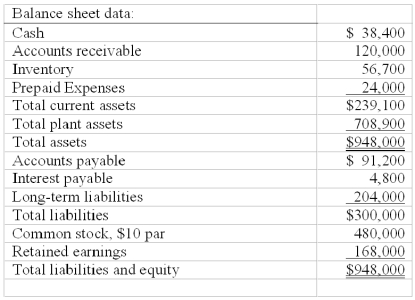

Use the following information from the current year financial statements of a company to calculate the ratios below:

(a) Current ratio.

(b) Accounts receivable turnover. (Assume the prior year's accounts receivable balance was $100,000.)

(c) Days' sales uncollected.

(d) Inventory turnover. (Assume the prior year's inventory was $50,200.)

(e) Times interest earned ratio.

(f) Return on common stockholders' equity. (Assume the prior year's common stock balance was $480,000 and the retained earnings balance was $128,000.)

(g) Earnings per share (assuming the corporation has a simple capital structure, with only common stock outstanding).

(h) Price earnings ratio. (Assume the company's stock is selling for $26 per share.)

(i) Divided yield ratio. (Assume that the company paid $1.25 per share in cash dividends.)

Definitions:

Nominal Income

The total amount of money earned by an individual or entity before adjustments for inflation or deflation.

Leading Economic Indicators

Variables that predict, or lead to, a recession or recovery; examples include consumer confidence, stock market prices, business investment, and big-ticket purchases, such as automobiles and homes.

Business Cycle

The natural fluctuation of the economy between periods of expansion (growth) and contraction (recession).

Price Level

The average of current prices across the entire spectrum of goods and services produced in the economy, often measured by a price index.

Q35: _ are responsible for and have final

Q42: The following data were reported by a

Q106: Oakley Corporation has the following comparative income

Q121: For each of the following separate cases,

Q126: Jacob Corporation's salaries expense was $18.0 million.

Q131: Use the cash flow on total assets

Q155: A company paid cash dividends on its

Q158: One of the usual differences between financial

Q162: A basic present value concept is that

Q209: Par value of a stock refers to