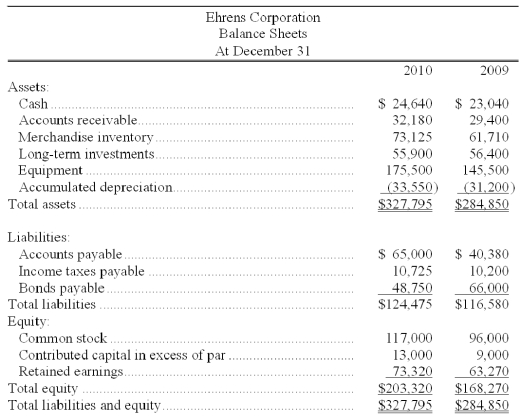

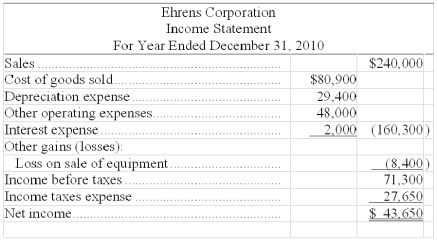

The following information is available for the Ehrens Corporation:

Additional information:

(1) There was no gain or loss on the sales of the long-term investments, nor on the bonds retired.

(2) Old equipment with an original cost of $37,550 was sold for $2,100 cash.

(3) New equipment was purchased for $67,550 cash.

(4) Cash dividends of $33,600 were paid.

(5) Additional shares of stock were issued for cash.

Prepare a complete statement of cash flows for the 2010 calendar year using the indirect method.

Definitions:

Fair Value

The price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants.

Defined Benefit Pension Plans

Pension plans that promise a specified monthly benefit at retirement, which may be calculated through a formula based on earnings and years of service.

Required Disclosure

Obligatory sharing of specific financial or operational information by a company, as mandated by regulatory bodies or laws.

Projected Benefit Obligation

A measurement of the present value of future pension liabilities, based on expected future salary increases.

Q18: Define and contrast period costs and product

Q60: Current liabilities are obligations not due within

Q67: Stockholders' equity consists of:<br>A) Long-term assets<br>B) Contributed

Q70: Classifying costs by behavior involves:<br>A) Identifying fixed

Q94: What methods can a company use to

Q106: Labor costs that are clearly associated with

Q136: On August 31, 2010 Victory Corporation's common

Q145: Explain how to compute book value per

Q145: A company's transactions with its creditors to

Q168: Costs that are incurred as part of