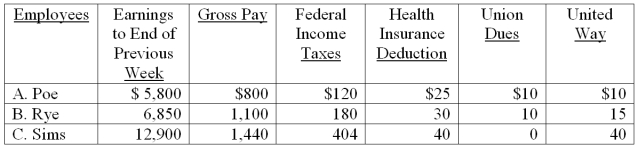

The payroll records of a company provided the following data for the currently weekly pay period ended March 7.

Assume that the Social Security portion of the FICA taxes is 6.2% on the first $106,800 and the Medicare portion is 1.45% of all wages paid to each employee for this pay period. The federal and state unemployment tax rates are 0.8% and 5.4%, respectively, on the first $7,000 paid to each employee.

Calculate the net pay for each employee.

Definitions:

Androgyny

A blend of both masculine and feminine characteristics in an individual's personality, appearance, or behavior.

Gender-typing

The process of associating objects, activities, roles, or traits with one gender in ways that conform to cultural stereotypes.

Influential Individual

A person who has the power to affect the opinions, behaviors, or decisions of others through their actions, status, or expertise.

Father

A male parent or guardian.

Q6: The following information is from the

Q26: A company declared a $0.50 per share

Q48: The number of days' sales uncollected:<br>A) Is

Q69: Obligations not expected to be paid within

Q126: Assume that at the end of the

Q132: On August 31, 2010 Victory Corporation's common

Q152: A company received cash proceeds of $206,948

Q186: Money orders, cashier's checks and certified checks

Q194: On January 2, 2006, a company purchased

Q199: Book value per share:<br>A) Reflects the value