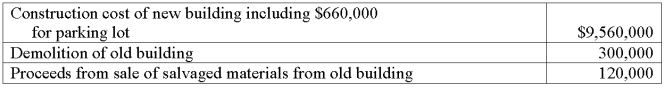

A company needed a new building. It found a suitable location with an existing old building on the land. The company reached an agreement to buy the land and the building for $960,000 cash. The old building was demolished to make way for the needed new building. Following is information regarding the demolition of the old building and construction of the new one:

Prepare a single journal entry to record the above costs assuming all transactions are paid in cash.

Definitions:

Revenues

The income generated from normal business operations and includes discounts and deductions for returned merchandise.

Tax

A financial charge or levy imposed by a government on individuals or entities to fund public expenditures, thereby shaping economic policies.

Laffer Curve

An illustration of the relationship between tax rates and tax revenue, suggesting there's an optimal tax rate that maximizes revenue.

Tax Revenue

The capital governments gather through the imposition of taxes.

Q23: The difference between the amount received from

Q42: When an asset is purchased (or disposed

Q45: _ is the electronic transfer of cash

Q62: A company issued 25-year, 8% bonds with

Q100: Advance ticket sales totaling $6,000,000 cash would

Q122: Plant assets refer to intangible assets that

Q128: Mission Company has three employees:<br> <span

Q160: If a 90-day note receivable is dated

Q161: Describe the accounting for intangible assets, including

Q185: Why is it a matter of good