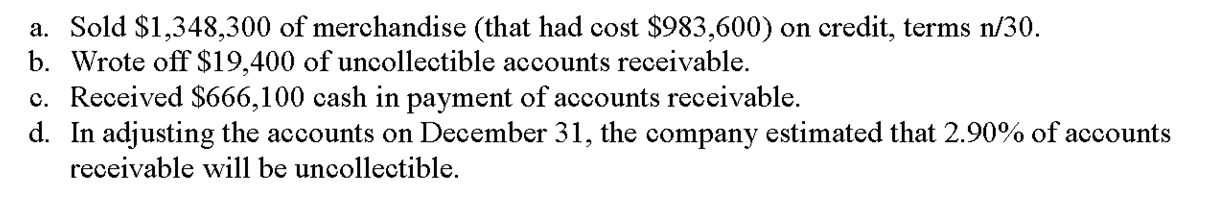

Vine Company began operations on January 1, 2010. During its first year, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows:

What is the amount required for the adjusting journal entry to record bad debt expense?

Definitions:

Opportunity Cost

The expense incurred by not choosing the second-best option available when a decision is made.

Sweaters

Clothing items made of wool or similar yarns, designed to provide warmth by covering the upper body.

Hats

A type of headwear that comes in various shapes, sizes, and materials, often used for fashion, protection, or ceremonial purposes.

Production

The process of creating goods or services by combining various inputs like labor, capital, and natural resources.

Q8: The inventory valuation method that results in

Q10: The matching principle requires:<br>A) That expenses be

Q10: Good internal control dictates that a person

Q22: A company purchased a special purpose

Q59: During January, a company that uses a

Q79: The quality of receivables refers to the

Q91: The FICA tax for social security is

Q112: _ are costs that increase the usefulness

Q118: Amortization is the process of allocating the

Q176: A company had net sales of $541,500