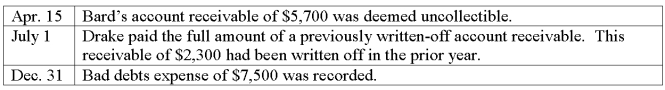

Timmons Company had a January 1, credit balance in its Allowance for Doubtful Accounts of $7,000 for the current year. The following transactions and events affected the Allowance for Doubtful Accounts during the current year:

What amount should appear in the allowance for doubtful accounts in the December 31, balance sheet for the current year?

Definitions:

Tax-Deductible

A tax-deductible expense is one that can be subtracted from gross income to arrive at taxable income, effectively reducing the overall amount of taxes owed.

Operating Leverage

A measure of how revenue growth translates into growth in operating income, influenced by the proportion of fixed costs in a company's cost structure.

Financial Leverage

Leveraging debt to boost the potential yield of an investment.

Total Leverage

A measure that combines both operating and financial leverage to assess a company's total sensitivity to changes in output levels affecting its earnings before interest and taxes.

Q10: Good internal control dictates that a person

Q12: If Jefferson Company paid a bonus equal

Q21: Explain the difference between the retail inventory

Q45: A company purchased a tract of land

Q49: In the retail inventory method of inventory

Q61: Three key variables determine the dollar value

Q64: The following information is from the

Q91: A method that charges the same amount

Q103: How is the cost principle applied to

Q156: Wal-Mart had income before interest expense and