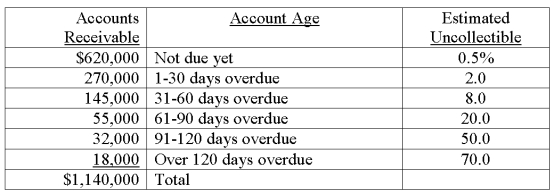

A company uses the aging of accounts receivable method to estimate its bad debts expense. On December 31 of the current year an aging analysis of accounts receivable revealed the following:

Required:

a. Calculate the amount of the Allowance for Doubtful Accounts that should be reported on the current year-end balance sheet

b. Calculate the amount of the Bad Debts Expense that should be reported on the current year's income statement, assuming that the balance of the Allowance for Doubtful Accounts on January 1 of the current year was $44,000 and that accounts receivable written off during the current year totaled $49,200

c. Prepare the adjusting journal entry to record bad debts expense on December 31 of the current year

d. Show how Accounts Receivable will appear on the current year-end balance sheet as of December 31

Definitions:

Fixed Expenses

Costs that do not change with the level of production or sales activities within a certain range and time period.

Break-Even

Break-even is the point at which total costs and total revenue are equal, resulting in no net loss or gain.

Seed Division

A segment within a business or organization that focuses on developing new ideas, projects, or business lines from their initial stages.

Fixed Expenses

Costs that do not change with the level of production or sales within a certain range, such as rent and salaries.

Q14: Controls of cash disbursements are important for

Q77: The acid-test ratio is also called the

Q89: The document the purchasing department sends to

Q124: A plant asset's useful life might not

Q128: Mission Company has three employees:<br> <span

Q129: The aging of accounts receivable involves classifying

Q182: A company's annual accounting period ends on

Q187: At the end of the day,

Q187: _ depreciation charges a varying amount to

Q201: On July 1 of the current year,