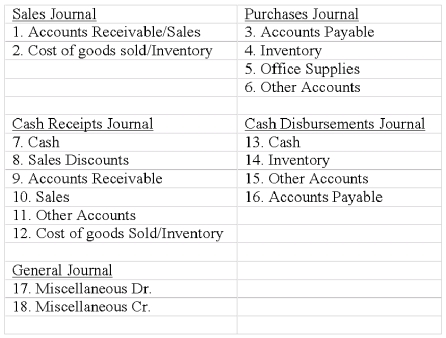

A company records its transactions and events in four special journals and a general journal. The amount columns of these journals are numbered as follows:

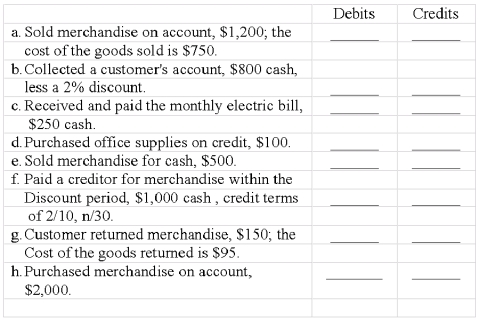

Show how each of the following transactions would be recorded in the above set of accounting journals by inserting the number(s) of the columns in which the debit(s) would appear in the column labeled "Debits" below and by inserting the number(s) of the columns in which the credits would appear in the column labeled "Credits" below.

Definitions:

Tax Liability

The sum total of taxes that an individual, corporation, or other entity is required to pay to a government body.

Single Person

An individual who is unmarried or legally separated from a spouse, affecting their tax filing status and benefits.

Taxable Income

The portion of an individual's or corporation's income used to determine how much tax is owed to the federal government or other taxing authorities.

Tax Liability

The total amount of tax that an individual or business is legally obligated to pay to a tax authority based on earnings or profit.

Q12: Presented below is selected financial information for

Q14: Three of the following procedures or techniques

Q14: Well-designed research manages to minimize or avoid:<br>A)assumptions.<br>B)predictions.<br>C)theory.<br>D)bias.

Q15: One indication that a piece of information

Q21: Morgan Company purchased 2,000 shares of Asta's

Q86: David Roberts is a real estate appraiser.

Q118: _ is the accounting system component that

Q133: The cost-benefit principle affects all other accounting

Q196: List the steps in processing transactions.

Q258: If the assets of a business increased