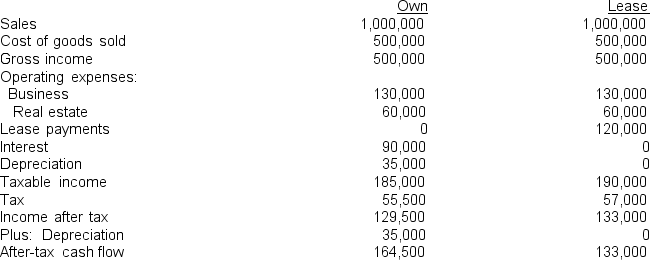

A company is planning to move to a larger office and is trying to decide if the new office should be owned or leased.Cash flows for owning versus leasing are estimated as follows.Assume that the cash flows from operations will remain level over a 10 year holding period.If purchased,the company will invest $385,000 in equity and finance the remainder with an interest-only loan that has a balloon payment due in year 10.The after-tax cash flow from sale of the property at the end of year 10 is expected to be $750,000.What is the incremental rate of return on equity to the company,if the property is owned instead of leased?

Definitions:

Q8: Which of the following is not one

Q10: Your friend has a trust fund that

Q12: One difference between the constant amortizing mortgage

Q12: Social responsibility is<br>A)an organization's obligation to maximize

Q18: If a property owner borrows money at

Q20: The term "due diligence" refers to doing

Q23: It is difficult to compare the investment

Q24: Lender's can partially avoid estimating interest rates

Q30: A property is encumbered as follows: First

Q46: Identify three things that a pregnant mother