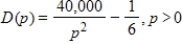

Suppose that the demand for a product depends on the price p according to  , where p is in dollars. Find and explain the meaning of the instantaneous rate of change of demand with respect to price when

, where p is in dollars. Find and explain the meaning of the instantaneous rate of change of demand with respect to price when  .

.

Definitions:

Significant Influence

The capacity, through investment ownership, to impact the management and policies of another company without having full control.

Net Income

The consummate earnings of a company following the subtraction of all operational costs and tax liabilities from its gross revenue.

Dividends

Payments made by a corporation to its shareholders, usually from profits.

Equity Method

An accounting technique used by companies to assess the profits earned by their investments in other companies, where the investment is recorded initially at cost and adjusted thereafter for the post-acquisition change in the investor's share of the investee's net assets.

Q1: The nurse is preparing a historical research

Q2: The nurse researcher is preparing information to

Q5: Find the derivative of the given function.

Q11: The nurse has participated in several research

Q14: What is the fifth term of the

Q40: Similar to the subject matter of Romanesque

Q54: What is the size of the payments

Q124: A frustrated store manager is asked to

Q162: Suppose that all license plates in a

Q209: Because the derivative of a function represents