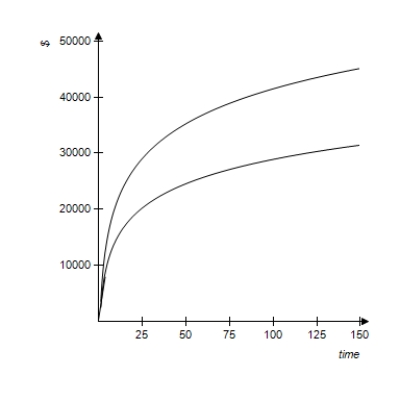

The following figure shows a graph that compares the present values of two ordinary annuities of $800 quarterly as functions of the number of quarters. One annuity is at an annual rate of 6% compounded quarterly, and the other is at 9% compounded quarterly. What present value is required to purchase an annuity of $800 a quarter for 25 years with an interest rate of 9% compounded quarterly? Check your answer against the graph. Round your answer to the nearest cent.

Definitions:

Marginal Tax Rate

The percentage of tax levied on the last dollar of an income earner's taxable income, reflecting the tax applied to each income level for which the taxpayer is eligible.

After-Tax Cost

The net cost of an investment or financing after taking into account the effects of taxation.

Dividend Growth

Refers to the year-over-year increase in dividends paid out by a company, indicating its ability to generate increasing profits over time.

Gordon Model

A model used to determine the value of a stock by assuming a dividend grows at a constant rate indefinitely.

Q7: During four years of college, Nolan MacGregor's

Q41: Suppose a pair of dice is thrown

Q61: A multiple-choice test has 28 questions and

Q65: Find S: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Find S:

Q65: Graph the function. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Graph

Q71: Suppose that sales (in dollars) are directly

Q76: The following technology matrix describes the relationship

Q109: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="If ,

Q135: In the analysis of traffic flow, a

Q148: Total revenue is in dollars and x