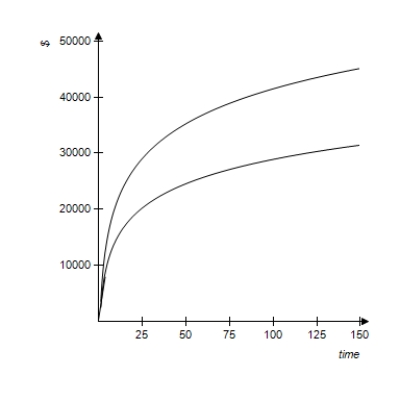

The following figure shows a graph that compares the present values of two ordinary annuities of $800 quarterly as functions of the number of quarters. One annuity is at an annual rate of 6% compounded quarterly, and the other is at 9% compounded quarterly. What present value is required to purchase an annuity of $800 a quarter for 25 years with an interest rate of 9% compounded quarterly? Check your answer against the graph. Round your answer to the nearest cent.

Definitions:

Double Taxation

The imposition of two separate taxes on the same asset, income, or financial transaction, often seen when corporate earnings are taxed both at the corporate level and again when distributed as dividends to shareholders.

Corporation

A legal entity recognized by law as separate from its owners, with its own rights, responsibilities, and liabilities.

Going-concern Assumption

An accounting principle that assumes a business will continue to operate indefinitely, rather than being liquidated.

Q5: If $4,500 is invested at an annual

Q22: In a 10-question matching test with 10

Q23: Find the variance of the set of

Q67: Find the mean of the following data.

Q79: Graph the inequality. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Graph

Q98: Suppose that the equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Suppose

Q111: Use a table of the standard normal

Q145: Use technology to find the determinant.

Q158: Use the matrices to find BA, if

Q160: Find the derivative of the given function.