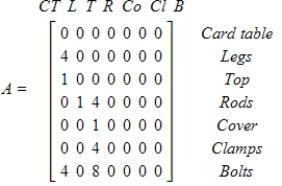

Card tables are made by joining 4 legs and a top using 4 bolts. The legs are each made from a steel rod. The top has a frame made from 4 steel rods. A cover and four special clamps that brace the top and hold the legs are joined to the frame using a total of 8 bolts. The parts-listing matrix for the card table assembly is given by

If an order is received for 10 card tables, 4 legs, 1 top, 2 covers, 6 clamps, and 13 bolts, how many of each primary assembly item are required to fill the order?

Definitions:

MACRS

Modified Accelerated Cost Recovery System, a method of depreciation for tax purposes in the United States that allows faster write-offs of assets.

Straight-Line

A method of calculating depreciation of an asset, which allocates an equal amount of depreciation to each year of the asset's useful life.

Sum-Of-Years' Digits

A depreciation method that accelerates the expense recognition, using a decreasing fraction of years remaining over the sum of the years' digits.

Double-Declining Balance

A method of accelerated depreciation which doubles the normal depreciation rate, reducing the asset's book value more quickly in its early years.

Q66: Solve the exponential equation. Give answers correct

Q71: Write a zero matrix that is the

Q92: If the profit from the sale of

Q94: If a firm has the following cost

Q99: Write the equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Write the

Q105: Solve the equation by using the quadratic

Q106: The following table gives the percent of

Q116: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="If and

Q180: A trust account manager has $220,000 to

Q209: Use a graphing utility with the standard