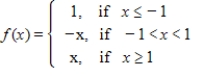

Sketch the graph of the function  .

.

Definitions:

Proportional Taxation

The tax as a percentage of income remains constant as income increases; also called a flat tax.

Regressive Taxation

The tax as a percentage of income decreases as income increases.

Progressive Taxation

Progressive taxation is a tax system where the tax rate increases as the taxable amount or income of the taxpayer increases, making it proportionally more significant for higher-income earners.

Proportional Taxation

A tax system where the tax rate is fixed and does not change with the income level of the taxpayer, implying everyone pays the same percentage of their income in taxes.

Q1: Use the following information. Chemists use the

Q15: Using data from the Internal Revenue Service,

Q59: If a box with a square cross

Q59: Use the formula <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Use the

Q89: Determine what value of x gives the

Q96: Use a change-of-base formula to rewrite the

Q98: Suppose that the equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Suppose

Q102: A system of equations may have a

Q186: Use the following matrices to perform the

Q193: A linear revenue function is <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg"