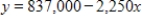

When a $837,000 building is depreciated for tax purposes (by the straight-line method) , its value y after x months of use is given by  . How many months will it be before the building is fully depreciated (that is, its value is $0) ?

. How many months will it be before the building is fully depreciated (that is, its value is $0) ?

Definitions:

Keyboard Sensitivity

Refers to how responsive or receptive a keyboard is to key presses, affecting typing speed and accuracy.

Keyboard Shortcuts

Key combinations used to perform certain actions quickly without using a mouse.

Modified Date

The date on which a file or document was last altered.

Recent Version

The latest release or update of software or an application, offering new features, bug fixes, or improvements over previous versions.

Q2: The profit function for a certain commodity

Q3: Suppose that the economy of a small

Q9: A system of equations may have a

Q29: Suppose that a company's production for Q

Q36: A system of equations may have a

Q60: A bank lent <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="A bank

Q101: Suppose that the percent of total personal

Q105: The Wellbuilt Company produces two types of

Q155: Substitute the given values of x, y,

Q230: The United States' spending for military (in