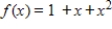

Let  . Is

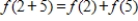

. Is  ?

?

Definitions:

Tax Depreciation

The depreciation expense allowed by tax authorities for the purpose of reducing taxable income, which may differ from book depreciation.

Book Depreciation

The method used by businesses to allocate the cost of a physical asset over its useful life for accounting and tax purposes.

Tax Rate

The percentage at which an individual or corporation is taxed, often varying by income or profits.

Income Taxes Payable

The amount of income tax a company owes to the government but has not yet paid.

Q2: The profit function for a certain commodity

Q36: When a stone is thrown upward, it

Q54: If the supply and demand functions for

Q84: The James MacGregor Mining Company owns three

Q97: Solve the following linear programming problem. <br>Maximize

Q99: Write the equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Write the

Q130: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="If is

Q130: Evaluate the definite integral <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Evaluate

Q136: Use inverse matrices to find the solution

Q198: Use the left-to-right elimination method to solve