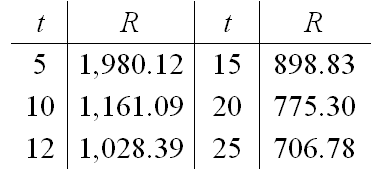

When a debt is refinanced, sometimes the term of the loan (that is, the time it takes to repay the debt) is shortened. Suppose the current interest rate is 7%, and the current debt is $100,000. The monthly payment R of the refinanced debt is a function of the term of the loan t in years. If we represent this function by  , then the following table defines the function.

, then the following table defines the function.

Source: Comprehensive Mortgage Payment Tables, Publication No. 492, Financial Publishing Co., Boston

Choose the correct verbal description of  .

.

Definitions:

Eco-branding Strategy

A marketing approach focusing on promoting a brand's commitment to environmental sustainability to appeal to eco-conscious consumers.

Significant Barriers

Major obstacles or hurdles that prevent or hinder progress towards an objective or the accomplishment of a goal.

Sustainable Value Innovation Strategy

This strategy focuses on creating economic value in a way that also creates value for society by addressing its needs and challenges, emphasizing sustainability in business practices.

Beyond Compliance Leadership Strategy

A strategy that involves going beyond minimal legal standards and regulations to integrate ethical practices and sustainability into a company's core operations.

Q2: The demand functions for q<sub>A</sub> and q<sub>B</sub>

Q14: In an effort to make the distribution

Q17: Solve the equation <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Solve the

Q42: When a $837,000 building is depreciated for

Q64: A contractor builds two types of homes.

Q95: If <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="If ,

Q114: The demand function for a certain product

Q188: A 58-year-old couple are considering opening a

Q225: Use inverse matrices to find the solution

Q286: A franchise models the profit from its