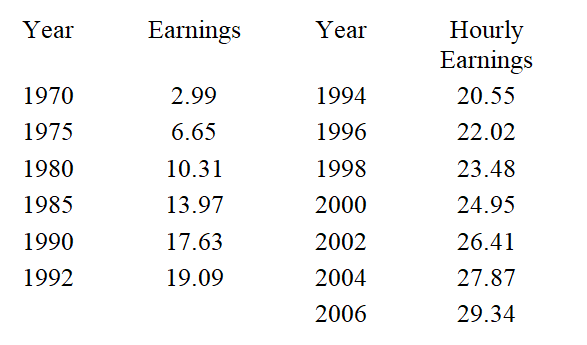

Suppose that the following table shows the average hourly earnings for full-time production workers in various industries for selected years. The linear regression equation for hourly earnings as a function of time is given by  (where x is the number of years after 1970 and y is the average hourly wage) . What does this model predict for the average hourly earnings in 2024? Round your answer to two decimal places.

(where x is the number of years after 1970 and y is the average hourly wage) . What does this model predict for the average hourly earnings in 2024? Round your answer to two decimal places.

Definitions:

Pro Forma Financial Statements

Financial statements that project the financial position of a company, based on certain assumptions and typically used for future planning.

Sales Forecast

A sales forecast is the process of estimating future sales. Accurate sales forecasts enable companies to make informed business decisions and predict short-term and long-term performance.

Financial Forecasting

The process of estimating or predicting how a business will perform in the future through its financial statements.

FA/Sales Ratio

The Fixed Asset to Sales Ratio compares a company's total amount of fixed assets to its sales revenue, indicating how efficiently the company uses its fixed assets to generate sales.

Q29: According to the U.S. Bureau of the

Q43: If a line is vertical, then its

Q47: Find the maximum value of the function

Q86: The following technology matrix describes the relationship

Q113: The demand functions for q<sub>A</sub> and q<sub>B</sub>

Q120: Use an integral formula to evaluate <img

Q160: Find the area of the shaded region.

Q185: Evaluate the improper integral if it converges,

Q275: When the area under <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="When

Q277: Use the Trapezoidal Rule to approximate <img