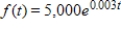

A franchise models the profit from its store as a continuous income stream with a monthly rate of flow at time t given by  (dollars per month) . When a new store opens, its manager is judged against the model, with special emphasis on the second half of the first year. Find the total profit for the second 6-month period

(dollars per month) . When a new store opens, its manager is judged against the model, with special emphasis on the second half of the first year. Find the total profit for the second 6-month period  to

to  . Round your answer to the nearest dollar.

. Round your answer to the nearest dollar.

Definitions:

Final Settlement

The last payment in an agreement, settling all outstanding balances and obligations.

Section 179

A provision in the U.S. tax code that allows businesses to deduct the full purchase price of qualifying equipment and/or software within the tax year it was purchased.

Maximum Deduction

The highest amount that can be subtracted from taxable income, as allowed by tax laws.

Cost Recovery Deduction

A tax deduction that allows a taxpayer to recover the cost of an investment over time through depreciation, amortization, or depletion.

Q44: For the given function, find <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg"

Q47: Evaluate the integral <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Evaluate the

Q59: For the given function and graph, estimate

Q120: Use an integral formula to evaluate <img

Q140: Suppose the number of daily sales of

Q151: A 58-year-old couple are considering opening a

Q161: The demand function for a product is

Q304: Suppose a land developer is planning to

Q339: Assume that the tax burden per capita

Q360: For the interval [-5,2] and for n