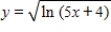

Find  .

.

Definitions:

Marginal Tax Rate

The rate at which an additional dollar of income is taxed, representing the percentage of tax applied to the last dollar earned.

Tax-Free

Tax-free describes goods, transactions, or income that are not subject to taxation by the government.

Taxed

Subjected to a financial charge or levy by a government on income, goods, or activities.

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, resulting in those who have higher incomes being taxed at a higher rate.

Q51: p is in dollars and q is

Q58: Assume that the tax burden per capita

Q67: Use an integral formula to evaluate <img

Q75: The rate of change of atmospheric pressure

Q79: Which of the following integrals cannot be

Q101: A product can be produced at a

Q126: Evaluate the integral <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Evaluate the

Q158: For the given function, find all intervals

Q177: Evaluate the integral <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Evaluate the

Q335: The United States' spending for military (in