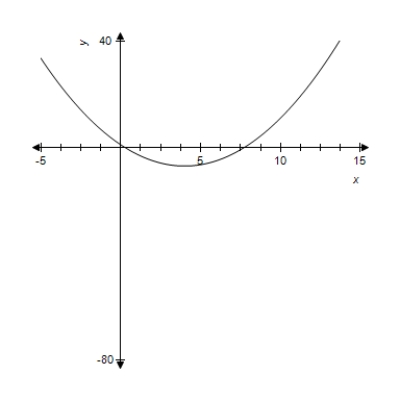

For the given function, use the graph to identify x-values for which  . You may use the derivative to check your conclusion.

. You may use the derivative to check your conclusion.

Definitions:

Progressive Tax

A taxation system where the tax rate increases as the taxable amount increases, typically leading to higher earners paying a larger percentage of their income than lower earners.

Tax

A compulsory financial charge or some other type of levy imposed on a taxpayer by a governmental organization in order to fund government spending and various public expenditures.

Proportional

Pertaining to a relationship where quantities change at the same rate, maintaining a constant ratio.

Taxable Income

The portion of an individual's or business's income used to determine how much tax will be owed to the federal government.

Q5: The monthly demand function for x units

Q12: Based on data adapted from the National

Q50: Total personal income in the U.S. (in

Q88: Suppose that a liquid carries a drug

Q89: The probability density function for the life

Q154: Evaluate the definite integral <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Evaluate

Q198: With data for 1990 to 2002, the

Q219: For what value of a is <img

Q261: Use integration by parts to evaluate <img

Q334: For the interval [-5,2] and for n