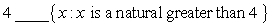

Use or in blank place to indicate whether the given object is an element of the given set.

Definitions:

Depreciation

The reduction in the value of an asset over time, particularly for tax purposes.

Equipment

Tangible property used in operations, such as machinery or computer hardware, which can often be depreciated for tax purposes.

Capital Asset

A long-term asset such as equipment, real estate, or securities, which is not easily sold in the regular course of a business's operations for cash.

Taxpayer's Home

The primary place of abode of a taxpayer that determines tax liabilities and benefits.

Q6: In standing, forward rotation of the pelvis

Q12: Approximately how many degrees of hip and

Q18: Gait can be defined as:<br>A) the manner

Q19: Rewrite the following so that only the

Q21: Simplify the fraction. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4005/.jpg" alt="Simplify the

Q23: The approximate percent P of average income

Q41: The demand functions for specialty steel products

Q63: Suppose that the monthly revenue and cost

Q146: Suppose the average costs of a mining

Q149: Sketch the graph of the function <img