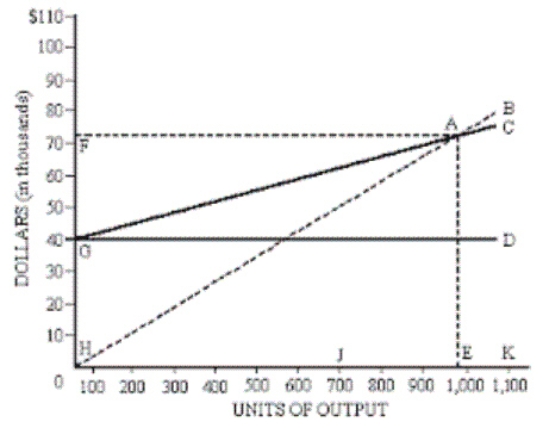

The following graphical breakeven analysis is for Nicronea's new line of desktop computers. Questions related to the graph should be answered in the spaces provided.

a. Production at point J would be at a __________.

b. The area depicting profitable operations is __________.

c. The fixed costs area is within letters __________.

d. The total revenue area is within letters ___________.

e. The breakeven point for sales units is at letter __________.

f. Letter A represents __________.

g. The line H-B represents what C-V-P element? ___________.

h. Total cost of operations is reflected in line __________.

Definitions:

Optimum

The most favorable condition or level for growth, reproduction, or success.

Holding Cash

The act of retaining liquid currency or cash equivalents by individuals or firms as a part of their financial strategy, to cover expenses or for speculative purposes.

Interest Rate

The percentage charged or paid for the use of money on a loan or investment, typically expressed as an annual percentage rate (APR).

Miller-Orr Model

A financial management model used to determine the optimal level of cash balance a company should maintain, considering the costs of cash management and the variability of cash flows.

Q23: Which of the following provides an explanation

Q24: Allan International is in the construction

Q27: A process costing system accounts for product

Q38: The total fixed overhead variance is comprised

Q63: For a bank, a credit check of

Q70: When calculating ROI, assets invested represent the

Q98: For every unit that a company produces

Q98: Compute the fixed overhead variance.<br>A) $5,000

Q110: A nonvalue-adding activity is one that increases

Q121: What are the results of the successful