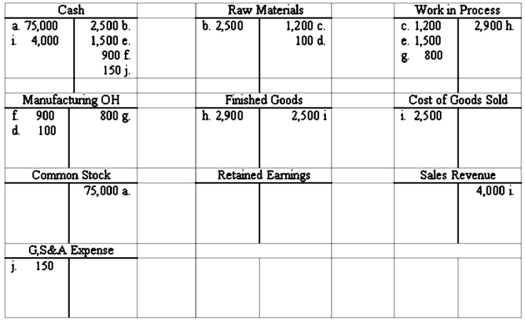

Selected accounts from Harper Company are provided below:

Required:

In the space provided, briefly describe each indicated transaction. Transaction (a) has been completed as an example.

Definitions:

Permitted Deductions

Allowable subtractions from gross income that reduce taxable income, as defined by tax laws.

Flat Tax

A tax system with a constant rate, where taxpayers pay the same percentage of their income regardless of the level of their income.

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the percentage of tax applied to your income for each tax bracket in which you qualify.

Average Tax Rate

The proportion of total income paid in taxes, calculated by dividing total tax amount by total income.

Q10: Responsibility reports are prepared:<br>A)for each manager who

Q16: A hybrid cost system contains:<br>A)Features of a

Q16: Cash outflows generated by capital investments include

Q19: Actual overhead costs are debited to the

Q28: The budgeting technique that provides for employee

Q47: Tisdale Company started the year with the

Q51: Can a company have a negative cash

Q52: When the effect of income taxes is

Q104: As of December 31, Year 1, Gant

Q122: Which of the following statements is false?<br>A)Under