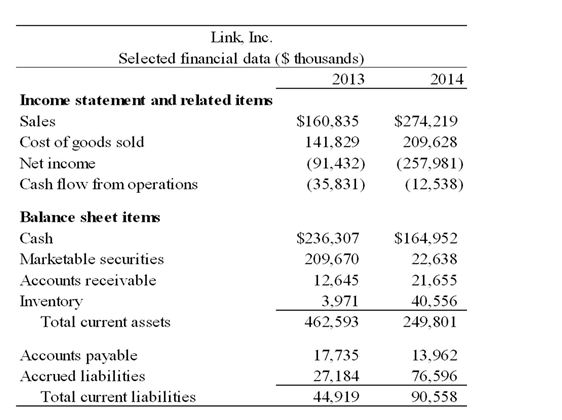

-Please refer to the financial data for Link,Inc.above.Assume a 365-day year for your calculations.Link's days' sales in cash at the end of 2014 is:

Definitions:

Personal-Use Property

Items owned for personal enjoyment or use, such as a residence or car, that typically do not qualify for tax deductions or depreciation.

FMV

Fair Market Value is an estimate of the market value of a property or asset, based on what a knowledgeable, willing, and unpressured buyer would likely pay to a knowledgeable, willing, and unpressured seller.

§179 Expense

A section of the U.S. tax code that allows a business to deduct the full purchase price of qualifying equipment or software within the tax year.

Business Assets

Economic resources or items of value owned by a company that are expected to provide future benefits or profits.

Q1: This is all pre-store communication and promotion

Q3: In a conversation with a friend,Lionel makes

Q6: Donna, a rehabilitation counseling participant, suffered a

Q8: A competent therapist remains _ in the

Q14: A recommended tool used for successfully terminated

Q14: Which one of the following is the

Q19: In comparison to industry averages,Okra Corp.has a

Q21: Issue costs of equity are high relative

Q23: Which one of the following statements is

Q30: Types of efficient lighting includes all EXCEPT:<br>A)Fluorescents<br>B)Incandescent<br>C)LED