Tran Company has the following financial statements for the year ended December 31,2016. Tran Compary

Balance Sheet

For 2016

Cash Accounts Receivable Inventory Current Assets Long-Lived Assets Total Assets Current Liabilities Long-Term Debt Shareholder Equity Total Debt and Equity $1,600,0003,000,0002,500,000$7,100,00014,500,000$21,600,000$1,200,0002,400,00018,000,000$21,600,000

Tran Compary

Income Statement

For Y ear Ended Dec. 31, 2016

Sales Cost of Sales Gross Margin Operating Expenses Operating Income Taxes Net Income $20,000,00015,000,000$5,000,0002,500,000$2,500,0001,000,000$1,500,000

Tran Compary

Cash Flows from Operations

For Y ear Ended Dec. 31, 2016

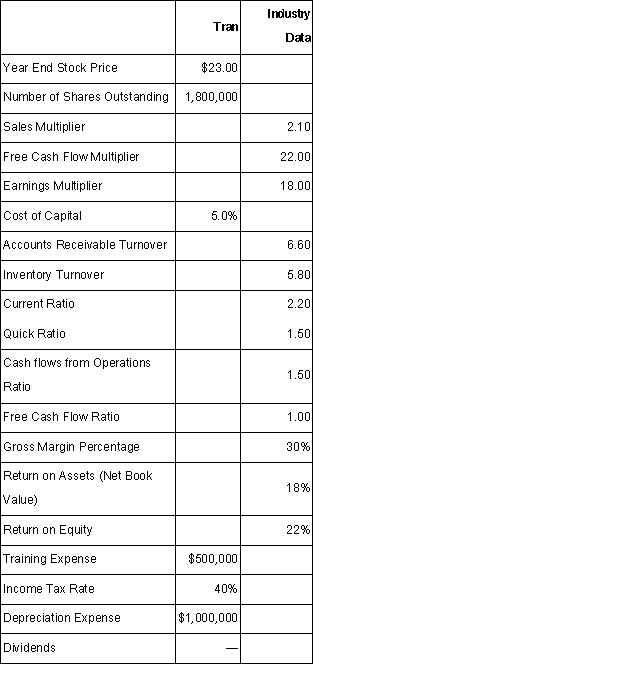

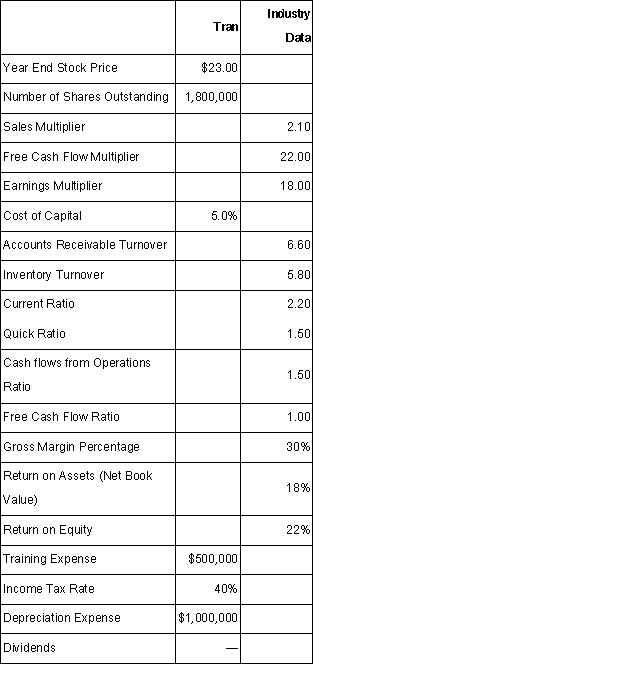

Net Income Plus Depreciation Expense + Decrease (- Inc rease) in Acct. Rec. & Inventory + Increase (-Dec rease) in Current Liabilities Cash Flows from Operations $1,500,0001,000,000$2,500,000 Some additional information about 2016 includes:

Required:

1.Complete a business analysis of Tran Company for 2016.2.Complete a business valuation for Tran Company for 2016.

Definitions:

Free Association

A psychoanalytic technique where patients are encouraged to share thoughts, words, or images that enter their mind to uncover unconscious thoughts and feelings.

Suppression

The conscious act of stopping oneself from thinking or feeling certain unwanted thoughts or emotions.

Cognitive Mapping

The process of using mental representations to acquire, code, store, recall, and decode information about the relative locations and attributes of phenomena in their everyday or metaphorical spatial environment.

Mindfulness Meditation

A form of meditation focusing on being intensely aware of what you're sensing and feeling in the moment, without interpretation or judgment.