Tran Company has the following financial statements for the year ended December 31,2016. Tran Compary

Balance Sheet

For 2016

Cash Accounts Receivable Inventory Current Assets Long-Lived Assets Total Assets Current Liabilities Long-Term Debt Shareholder Equity Total Debt and Equity $1,600,0003,000,0002,500,000$7,100,00014,500,000$21,600,000$1,200,0002,400,00018,000,000$21,600,000

Tran Compary

Income Statement

For Y ear Ended Dec. 31, 2016

Sales Cost of Sales Gross Margin Operating Expenses Operating Income Taxes Net Income $20,000,00015,000,000$5,000,0002,500,000$2,500,0001,000,000$1,500,000

Tran Compary

Cash Flows from Operations

For Y ear Ended Dec. 31, 2016

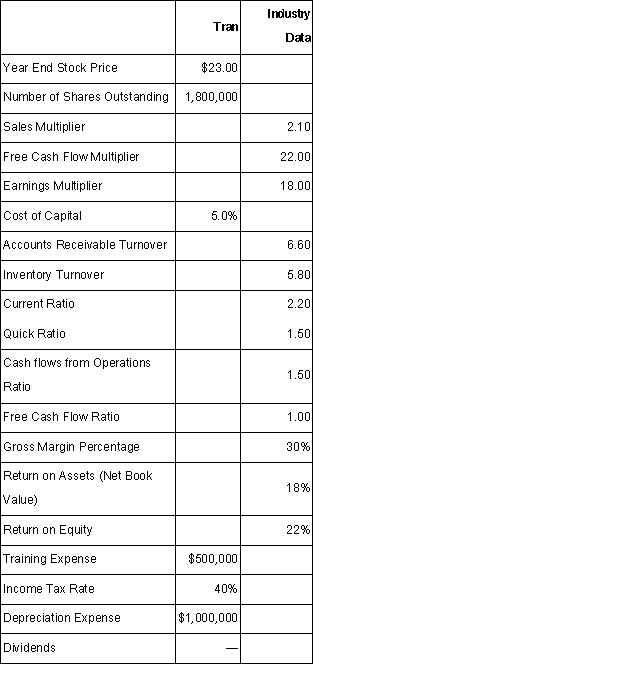

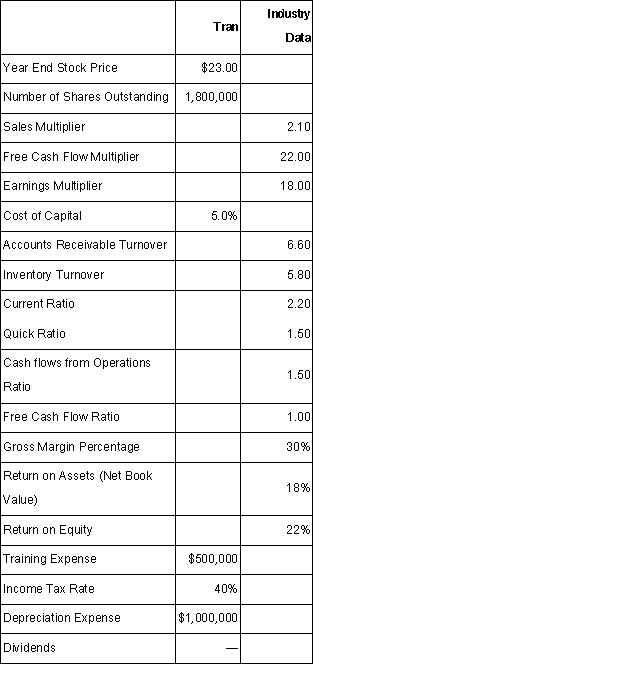

Net Income Plus Depreciation Expense + Decrease (- Inc rease) in Acct. Rec. & Inventory + Increase (-Dec rease) in Current Liabilities Cash Flows from Operations $1,500,0001,000,000$2,500,000 Some additional information about 2016 includes:

Required:

1.Complete a business analysis of Tran Company for 2016.2.Complete a business valuation for Tran Company for 2016.

Definitions:

Gluteus Maximus

The largest and most superficial of the three gluteal muscles, situated in the buttocks, responsible for movement of the hip and thigh.

Enlarged

Refers to an increase in size or volume, commonly used to describe a change in physical dimensions of an object or organism.

Cerebral Cortex

The outer layer of the brain's cerebrum, involved in complex functions like consciousness, thought, emotion, and memory.

Innate Ability

A natural skill or talent an individual is born with, not acquired through learning.