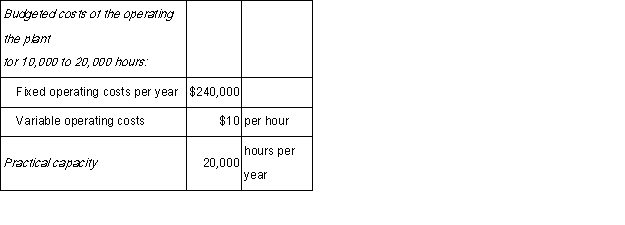

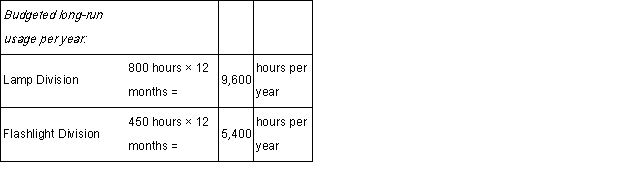

The Michael Vamosi Corporation operates one central plant that has two divisions,the Lamp Division and the Flashlight Division.The following data apply to the coming budget year:

Assume that practical capacity is used to calculate the allocation rates.Further assume that actual usage of the Lamp Division was 700 hours and the Flashlight Division was 400 hours for the month of June.Required:

Assume that practical capacity is used to calculate the allocation rates.Further assume that actual usage of the Lamp Division was 700 hours and the Flashlight Division was 400 hours for the month of June.Required:

a.If a single-rate cost-allocation method is used,what amount of operating costs will be budgeted for the Lamp Division each month? For the Flashlight Division each month?

b.For the month of June,if a single-rate cost-allocation method is used,what amount of cost will be allocated to the Lamp Division? To the Flashlight Division? Assume actual usage is used to allocate operating costs.c.If a dual-rate cost-allocation method is used,what amount of operating costs will be budgeted for the Lamp Division each month? For the Flashlight Division each month?

d.For the month of June,if a dual-rate cost-allocation method is used,what amount of cost will be allocated to the Lamp Division? To the Flashlight Division? Assume budgeted usage is used to allocate fixed operating costs and actual usage is used to allocate variable operating costs.

Definitions:

NPV Calculations

A method used to evaluate the profitability of an investment by calculating the difference between the present values of cash inflows and outflows over a period of time.

Cash Flow Projections

Estimates of the amount of money expected to flow in and out of a business over a certain period.

Discount Rate

This is the rate used during discounted cash flow analysis for evaluating the present value of cash flows anticipated in the future.

Financial Break-even Point

It is the level of revenue necessary to cover a company’s fixed and variable costs, without generating profit or loss.

Q4: Suade Inc.manufactures furniture and is organized

Q33: Morrison Supply provides the following information

Q44: The following information pertains to Zootime

Q77: One advantage of decentralization is faster response

Q90: The following set up is a

Q97: The Barton Creek Company has three

Q115: Kevin Montgomery Retail seeks your assistance

Q123: The Sunset Corporation operates one central plant

Q127: Which of the following measures is used

Q143: Talent Engineering has two divisions,Research and