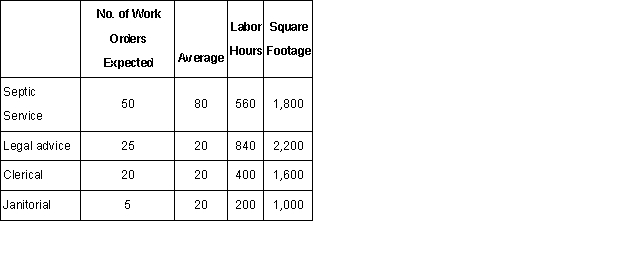

Steven Parker owns and operates Steven's Septic Service and Legal Advice.Steven's two revenue generating (production) operations are supported by two service departments: Clerical and Janitorial.Costs in the service departments are allocated in the following order using the designated allocation bases: Clerical:

Variable cost: expected number of work orders processed

Fixed cost: long-run average number of work orders processed

Janitorial:

Variable cost: labor hours

Fixed cost: square footage of space occupied

Average and expected activity levels for next month (June) are as follows: Expected costs in the service departments for June are as follows:

Expected costs in the service departments for June are as follows:

Under the direct method of allocation,what is the total amount of service cost allocated to the Legal Advice operation for June? (Round all calculations to the nearest whole dollar. )

Definitions:

Period Costs

Period costs are expenses that are not directly tied to production activities and are expensed in the period they are incurred; examples include administrative salaries and marketing costs.

Value Chain

The series of activities and processes that a company performs to add value to its product or service, from raw materials to final product delivery.

Management Functions

Fundamental tasks carried out by managers to achieve organizational goals, typically including planning, organizing, leading, and controlling.

Industry Averages

Statistical metrics that summarize the average performance, behavior, or characteristic of companies within a specific industry.

Q10: Bottlenecks in the production process can be

Q34: The Arkansas Company makes and sells a

Q39: The plantwide allocation concept cannot be used

Q43: Which of the following statement(s)is/are true? (A)If

Q67: If a budgeted activity base is used

Q93: The primary reason to use a dual

Q110: Fence Industries is preparing its annual

Q127: The Maryville Construction Company occupies 85,000

Q131: Vermicelli Company plans to sell 200,000 units

Q142: The Parts Division of the Stein Corporation