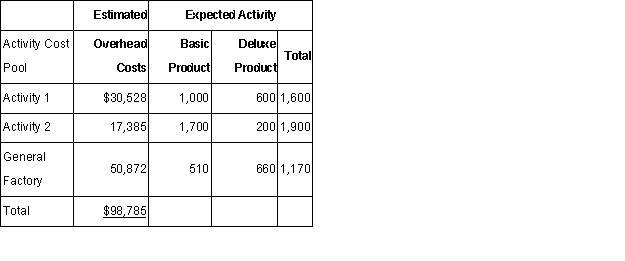

Markham Company makes two products: Basic Product and Deluxe Product.Annual production and sales are 1,700 units of Basic Product and 1,100 units of Deluxe Product.The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products.Basic Product requires 0.3 direct labor hours per unit and Deluxe Product requires 0.6 direct labor hours per unit.The total estimated overhead for next period is $98,785.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports.The new activity-based costing system would have three overhead activity cost pools-Activity 1,Activity 2,and General Factory-with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor hours. )

The predetermined overhead rate under the traditional costing system is closest to:

Definitions:

Language Acquisition Device

Hypothetical innate capability of human beings proposed by Noam Chomsky that allows for the learning of languages, especially during childhood.

Behaviourist Theory

A psychological approach that emphasizes the study of observable behaviors, especially as they pertain to the process of learning, without reference to mental states.

Overregularizations

A language development error where children apply grammatical rules too broadly, often observed in early language learning.

Nativist Theory

This theory posits that certain skills or abilities are innate and hardwired into the brain at birth.

Q2: Under Eagle Co.'s job order costing

Q64: QuikCard processes credit card receipts for local

Q65: Donnati Corporation has provided the following

Q106: Cordner Corporation has two production Departments: P1

Q112: The Marketplace Corporation produces two consumer

Q113: Fogel Flight Company uses a job-order costing

Q122: A company should use process costing,rather than

Q127: For Case (C)above,what is the Transferred-Out

Q133: Internal failure costs include materials wasted in

Q144: Which of the following methods provides no