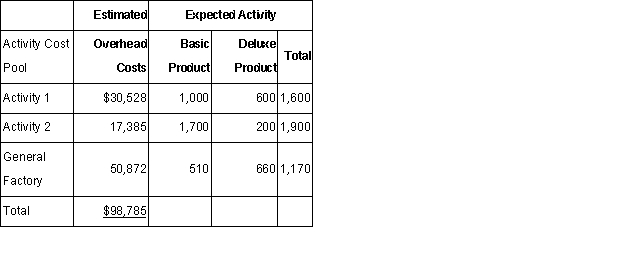

Markham Company makes two products: Basic Product and Deluxe Product.Annual production and sales are 1,700 units of Basic Product and 1,100 units of Deluxe Product.The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products.Basic Product requires 0.3 direct labor hours per unit and Deluxe Product requires 0.6 direct labor hours per unit.The total estimated overhead for next period is $98,785.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports.The new activity-based costing system would have three overhead activity cost pools-Activity 1,Activity 2,and General Factory-with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor hours. )

The predetermined overhead rate (i.e. ,activity rate) for Activity 2 under the activity-based costing system is closest to:

Definitions:

Hierarchical Relationships

Organizational or societal relationships in which individuals or groups are ranked one above the other according to status, authority, or some level of power.

State Power

The ability of a government to exert control and enforce laws over its territory and population.

Guest Worker

A person who is permitted to reside in a foreign country for the purpose of employment, usually temporarily.

Economic Restructuring

The changes in the structure of an economy, affecting its sectors or industries, often driven by technological advancements or globalization.

Q17: Glory Enterprises quality control report for

Q43: Carson Inc.has provided the following data

Q48: Merkel Industries has a traditional costing

Q50: Time equations can be used in extended

Q51: The following set up is a

Q60: Which of the following statements is(are)false? (A)Operations

Q62: Companies are continuously seeking ways to improve

Q72: Process costing systems do <b>not</b> separate and

Q141: For which of the following businesses would

Q147: The following cost data relate to