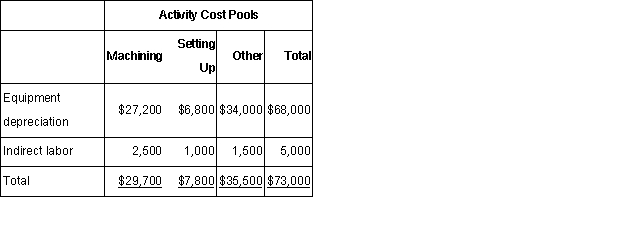

Yang Corporation has an activity-based costing system with three activity cost pools-Machining,Batch Setup,and Other.The company's overhead costs,which consist of equipment depreciation and indirect labor,have been allocated to the cost pools already and are provided in the table below.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs)and costs in the Batch Setup cost pool are assigned to products based on the number of batches.Costs in the Other cost pool are not assigned to products.Data concerning the two products and the company's costs appear below:

Required:

a.Calculate activity rates for each activity cost pool using activity-based costing.b.Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c.Determine the product margins for each product using activity-based costing.

Definitions:

Activity Report

A detailed account or summary of the tasks completed or progress made over a certain period.

Formal Proposal

A detailed and structured proposition or plan, often submitted for evaluation or funding purposes.

Inductive Reasoning

Reasoning that arrives at a general conclusion from specific instances or examples.

Reliable Cars

Describes vehicles known for their dependability, low maintenance, and minimal breakdowns, providing consistent performance over time.

Q16: Clean-Burn,Inc.is a small petroleum company that

Q106: The Document Creation Center (DCC)for Arlington

Q116: Brenda's Big Burgers,a small hamburger restaurant and

Q119: Silverton Manufacturing Company builds highly sophisticated

Q127: Which of the following measures is used

Q129: In computing the current period's manufacturing cost

Q132: Which of the following is a <b>weakness</b>

Q137: What is each component of the basic

Q144: The department cost allocation method provides more

Q147: Cost pools are:<br>A) costs that are accumulated