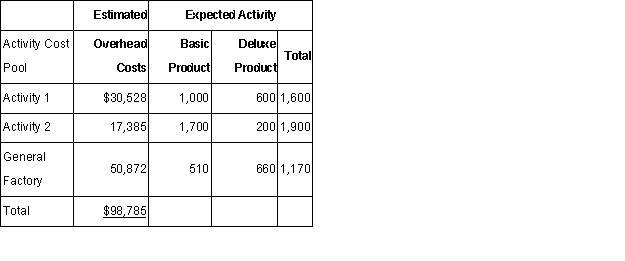

Markham Company makes two products: Basic Product and Deluxe Product.Annual production and sales are 1,700 units of Basic Product and 1,100 units of Deluxe Product.The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products.Basic Product requires 0.3 direct labor hours per unit and Deluxe Product requires 0.6 direct labor hours per unit.The total estimated overhead for next period is $98,785.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports.The new activity-based costing system would have three overhead activity cost pools-Activity 1,Activity 2,and General Factory-with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor hours. )

The predetermined overhead rate under the traditional costing system is closest to:

Definitions:

Maximize Profits

The process by which a business seeks to achieve the highest possible return from its operations, often through optimizing costs, pricing, and production strategies.

Marginal Revenue

The additional revenue that an entity receives from selling one more unit of a good or service.

Average Revenue

The amount of revenue received per unit of a good or service sold, calculated by dividing total revenue by the total number of units sold.

Maximize Profits

Business objective to achieve the highest possible profit from operations and sales.

Q14: "Beginning Balance (BB)plus Transfers Out (TO)equals Ending

Q24: A company has high winter demand and

Q33: Morrison Supply provides the following information

Q94: The classification of cost drivers into general

Q97: The Barton Creek Company has three

Q100: Flare Co.manufactures textiles.Among Flare's 2016 manufacturing

Q119: The journal entry to record actual manufacturing

Q130: Forensic Specialists developed the following information

Q149: Kingston Industries has four divisions,commercial,retail,research,and consumer,that share

Q150: Cost allocation bases are factors that cost